The mining business and mine stocks are characterized by volatility, and many investors can speculate. However, human history shows that investment in precious metals (gold, silver, platinum and palladium) are the best metals to invest in to protect against uncertainties in the future. Zinc, one of the most commonly used metals, is becoming increasingly scarce, with demand exceeding supply from mines.

UNDERSTANDING VOLATILITY AND RISK FACTORS IN THE MINING INDUSTRY

Mining continues to be a risky venture. Not only because of the volatility and cyclicality of commodity prices but also because of other risk factors that affect the performance of mining projects. These risks have been described by many. One representation of risk elements is the following 6 Ps (Armstrong, Champigny and Grimley, 1994):

Project risk has a direct correlation with the uncertainty in estimating the project’s fundamental asset, i.e. its mineral reserves. Project risks also include among other risks, location (remoteness, lack of infrastructure), availability of trained labour, and social acceptability by local communities regarding new mineral project developments, which has become increasingly important.

Process risk relates to the ability to achieve projected mining and mineral processing recoveries and to produce a saleable mineral product.

Pollution risk is rarely the inability to meet specific environmental standards but rather, the uncertainty in foreseeing the impact of rapidly changing environmental regulations and reacting to them. In most mineral producing countries, mine closure is becoming more costly and unpredictable.

People risk is determined based on the experience of the management team in executing projects of a similar type. If the senior executives’ only strength is in identifying orebodies, project financing may be very difficult to obtain and may require the appointment of experienced mine operators.

Price risk is one of the most significant factors by virtue of its tremendous impact on all projects. Accommodating price cyclicality continues to be the prime issue for executive management of mining companies. Price also receives the majority of the attention of financing agencies.

Politics, also known as the political risk, depends on a jurisdiction’s political and regulatory stability. Motivation to assess this risk results from the industry’s experience with nationalization and expropriation, and changes in financial parameters (royalties and taxation).

In view of rising prices since the early 1980s, considerable efforts have been made to find precious metal deposits worldwide. For a long time, precious metals have received the highest allocation of exploration dollars worldwide. The project risk related to finding precious metal mines is greater than it is for most mining projects as the concentrations that are being considered for precious metal deposits are only a few grams (or parts per million) per tonne of rock, and the variability of these concentrations can vary significantly.

WHAT DEFINES A PRECIOUS METAL?

A simple and good answer to this question is provided by Rhona O’Connell of GFMS Analytics (2005) in a report prepared for the World Gold Council (“WGC”) and is summarized here.

The answer lies in one word; “price”; and it is no coincidence that the word “precious” derives from the Latin pretium, meaning price, via the French term, précieux.

Precious metals are defined as “precious” due to their use in jewelry, both as an adornment and as an investment, while gold and silver have a very long history in coinage. Both of these two metals have high above-ground inventories. On the other hand, platinum and palladium are more “strategic” as they have relatively little history in coinage. Both have been part of the United States’ and Russia’s strategic stockpiles.

Gold is considered by many as the only truly “precious” metal. In comparison to other metals, gold is particular as a result of its unique geographical distribution of demand and the degree of discretionary spending. Gold price responds quickly to external forces and is more volatile than other metals.

Gold’s role as a risk-diversifier is well known and has been studied in depth by the WGC. The gold market’s strength and its liquidity renders gold as the most attractive of all the precious metals from an investment perspective.

WHY IS GOLD A GOOD INVESTMENT?

The WGC produces high-quality research on what drives the gold market, and the merits of investing in gold. According to a 2013 publication by the WGC, gold has unique properties as an asset class. Modest allocations to gold of a few percent can improve the performance of an investment portfolio significantly.

Retail buyers like gold’s investment properties even though gold still only makes up less than one per cent of investors’ asset allocations. A wide body of investors refer to gold as a solid, tangible and long-term store of value and that independent of other assets. Central banks of nations around the world use gold to mitigate portfolio risk.

WHY IS ZINC AN IMPORTANT METAL?

Zinc is one of the most widely used non-ferrous metals, following aluminum and copper, and is an essential material used in everyday life. The earliest use of zinc was in brass, whereby it was alloyed with copper. In 2016, the International Lead and Zinc Study Group reported that more than 13 million tons of zinc were produced worldwide.

The International Lead and Zinc Study Group (ILZCG)

The International Zinc Association states that about 60% of the metal produced is used for galvanizing to protect steel from corrosion, thus extending the life of steel products significantly. About 15% goes into the production of zinc-based alloys, mainly to supply the die casting industry; 14% is included in the production of brass and bronze, and 8% into the production of compounds such as zinc oxide and zinc sulfate. The remainder consists of zinc alloys, mainly rolled, utilized in a wide variety of applications.

The leading industries in terms of zinc usage are as follows:

- the construction industry (45%)

- the transportation sector (25%)

- consumption and consumer goods including electrical, and electronic appliances (23%)

- industrial machinery (7%).

THE DIFFERENCE BETWEEN EXPLORATION AND MINING COMPANIES

This is an important difference to understand. The Prospectors and Developers Association of Canada has provided the following analysis. Mineral exploration is the first stage of mine development. The majority of top mining producers maintain operational exploration departments, although various important mine discoveries were unveiled by commercial exploration companies. Although exploration companies sometimes become mining companies, exploration remains separate activity, with very different policy and financing requirements. Exploration companies (also known as ‘juniors’) are small, often have only a handful of full-time employees and usually rely on the capital markets for operating funds because they have no production revenue (Sphinx is a junior exploration company). Exploration companies are characterized by:

- Experienced founder(s) with financial credibility

- Entrepreneurial

- Small scale, most have no more than a handful of full-time employees

- Most exploration takes place in remote areas

- Majority of world’s exploration companies are owned by Canadians

- No productive revenue

- Depend on the capital markets to raise funds

- High-risk, speculative business, very few exploration projects lead to mine production

- Leave light environmental footprint

- Many exploration companies are working outside Canada

WHAT MINERAL EXPLORATION COMPANIES DO

Natural Resources Canada does a good job of summarizing what mineral exploration is and what activities are done by mineral exploration companies as follows.

Mineral exploration entails the search for materials in the earth’s crust that appear in high enough concentrations and amounts to be extracted and processed for profit. Mineral exploration comprises diverse objectives and activities, and starts by choosing a target area. The nature of the work fulfilled is dependent upon the minerals that are sought out. Pursuing potentially useful hints, which may evolve into a finding often requires a significant investment, and can take years to achieve. Few of such clues will transform into discoveries, however, pending clear definition of drilling and rock excavation related activities, the extent of the deposit, and cost studies have concluded that profitable extraction is possible. Mineral exploration usually continues after a mine has begun production, and can extend the initial projected mine lifecycle as additional mineral resources and reserves are defined.

Mineral exploration in Canada is mostly carried out by both Canadian junior and senior mining companies. Canada is particularly well known for the high participation rate of junior mining companies, which usually have no operating revenue and rely on equity financing. Typically, they aren’t particularly large, but they are flexible, and are involved in high-risk, preliminary exploration related activities. While some junior companies may decide to develop a project on their own or with a partner, senior companies (producers) are traditionally most likely to bring a mine into production. Part of the exploration work is completed by externally located or government-operated institutions.

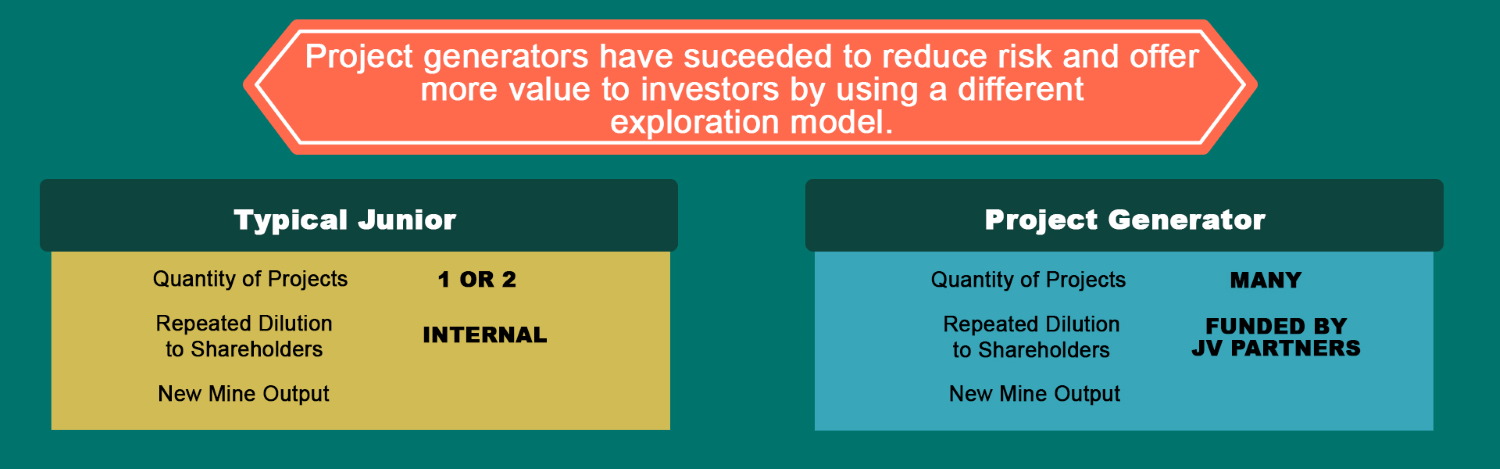

WHAT IS A PROJECT GENERATOR?

The illustration below from Visual Capitalist Infographic shows why project generators are successful.

An exploration project generator:

- Maintains a portfolio of projects, and funds major exploration work by creating partnerships with other companies.

- Concentrates on acquiring projects on the basis of their exploration potential.

- Builds a pipeline of quality projects.

In the case of Sphinx, other criteria area applied:

- Good social acceptability

- Ability to work throughout the year

- Complicated geology that we have the capacity to understand

Options projects to a reputable partner or carries out work to enhance the project’s exploration potential, so it is attractive to a partner.

Partners can consist of junior or senior mining companies. The partner agrees to fund the exploration work up to a certain stage, which results in reduced risk for the project generator company.

Project generators create shareholder value through:

Share price appreciation upon discovery of each project, even if there is a partner for the project.

Spin out – the creation of a new company following a discovery whereby shareholders will receive free shares in the new company, as well as retain their shares in the existing one.

Project acquisition by the partner, upon discovery.

WHY INVEST IN SPHINX?

Our team includes three mine finders

These are highly skilled individuals, with more than 100 years of combined experience, that have been part of discovery teams for gold, zinc and nickel mines that are in commercial production today in Quebec and other jurisdictions.

Quebec is considered one of the most attractive mining jurisdictions worldwide

Ranked 6th globally, Quebec has established itself as one of the world’s most attractive mining jurisdictions in the world. The Quebec government has created market confidence by taking a proactive approach to mining policy and regulations. Quebec’s mining sector has also been encouraged by the clarity and certainty on mining and environment regulations provided by its government. The Corporation’s team has considerable experience in mineral exploration in Quebec.

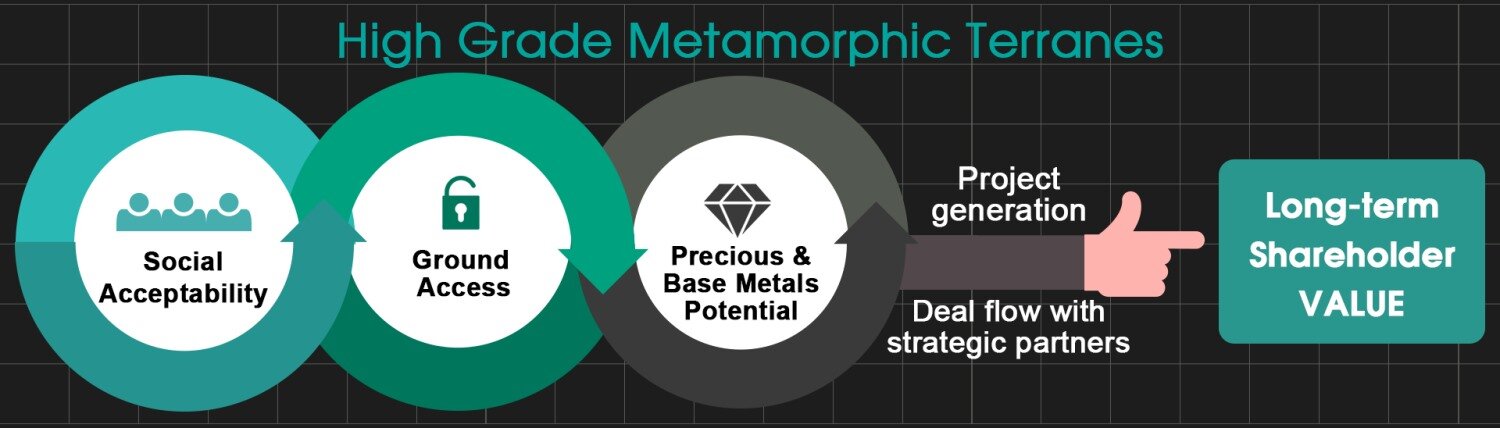

We are a Project generator

This means that we generate projects at an early stage in the exploration process. Project generators have better share performance than explorers that rely only on one or two projects. Managing multiple projects yields a better chance to find a mine. We specialize in generating projects in areas that are:

- Considered socially acceptable

- Located where we can explore all year round thus reducing the exploration cost

- Located where the geology is complicated – in geological terms complicated geology is known as high grade metamorphism.

We have unique exploration and mining expertise, which allows us to unravel that geology. This strategy is designed to create long-term shareholder value as illustrated below.

Sphinx has strong partners that contribute to fund its exploration projects

SOQUEM is the Quebec mineral exploration agency, which has been involved in discovering and developing eight mines over the course of 50 years, and is our partner for the Calumet-Sud project.

Sirios Resources – In the James Bay region, we have the privilege to work with our partner Sirios Resources, who has established a full exploration camp in the area and has received the 2016 discovery of the year award in Quebec for the nearby Cheechoo gold discovery next to Goldcorp’s Eleonore gold mine. Having partners also means that we do not issue as many shares, hence reducing shareholder dilution.

Sphinx has high quality precious metals and zinc projects

Currently, the Corporation has five projects. In 2017, Sphinx is going to work and drill on three projects. The first to be drilled is the Calumet-Sud zinc project in southwestern Quebec. The drill program is funded and operated by SOQUEM. This will be followed by drilling on the Green Palladium project and the Chemin Troïlus gold project. For the Cheechoo-Eleonore Trend gold project, extensive field work will be done with Sirios Resources to identify drill targets by the end of the year. Sirios’ camp is available for the field work and later for drilling.

Sphinx has a good shareholder base and committed ownership

Management, the Board of directors and the advisory committee hold 12% of the shares and Quebec institutions have 20%. The top 100 shareholders represent 85% of the total shares outstanding.

Why focus on precious metals and zinc?

- Precious metals include gold, silver, platinum and palladium. Not only is there a good price outlook for precious metals but areas worth exploring should have strong potential regarding precious metals.

- Palladium is part of the precious metals family but it is also a green metal used in catalytic converters to control gas emissions in vehicles. There is a growing demand for palladium due to expanding automotive production and more stringent governmental emission regulations. At the same time, there is a palladium deficit driven by the substitution of palladium for platinum in gasoline and diesel catalytic converter applications.

- Zinc is a key metal in our modern society and its prime use is to protect steel from rusting. It is also used in fertilizers and as a mineral supplement in food. Demand for zinc keeps growing while there is a shortage of new mine supply and new zinc projects.

REFERENCES

Armstrong, M., Champigny, N. and Grimley, P.H. Risk Analysis: The Importance of Reserve Estimation, in proceedings of 4th Large Open Pit Mining Conference, Perth, Australia, 5-9 September 1994, pp. 285-289.

World Gold Council, Rhona O’Connell, GFMS Analytics 2005. Gold:report – What sets the precious metals apart from other commodities? 8 pages, available on http://www.gold.org

World Gold Council, Gold Investor: Risk management and capital preservation, Volume 4, Why invest in gold? October 2013.

International Lead and Zinc Study Group – http://www.ilzsg.org

International Zinc Association – http://www.zinc.org

Prospectors and Developers Association of Canada – Mineral Exploration and Development fact sheet,http://www.pdac.ca/docs/default-source/public-affairs/fact-sheet-mineral exploration.pdf?sfvrsn=6

Natural Resources Canada – Canadian Mineral Exploration – https://www.nrcan.gc.ca/mining-materials/exploration/8290

Why Invest in Project Generators? An Altus – Visual Capitalist Infographic. February 2015. http://www.altus-strategies.com/s/AltusViews.asp?ReportID=696030